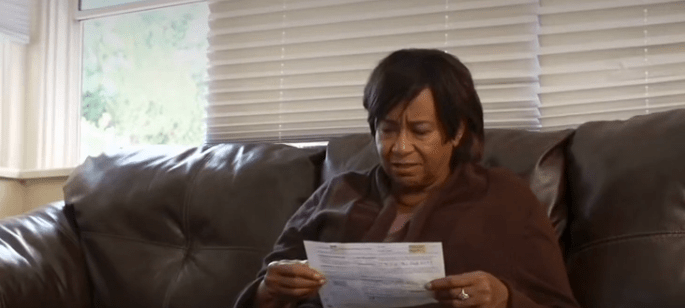

Steps to get a Loan Modification

The Mortgage Help Center is here to help you take the steps needed to get a loan modification. Fill in the form below to get started.

Here are some steps you can follow to try and get a loan modification:

- Contact your lender: The first step in the process is to reach out to your lender and explain your financial situation. Let them know that you are struggling to make your mortgage payments and ask if they have any options available to help you.

- Gather documentation: Your lender will likely ask for documentation to support your request for a loan modification. This may include proof of income, proof of expenses, and a hardship letter explaining the circumstances that have led to your inability to make your mortgage payments.

- Consider a government program: If you are unable to get a loan modification through your lender, you may be able to get help through a government program such as the Making Home Affordable Program. This program offers a range of options for homeowners facing financial hardship, including loan modifications and refinancing.

- Seek legal assistance: If you are having difficulty negotiating a loan modification on your own, you may want to consider seeking legal assistance. A lawyer experienced in this area can help you understand your options and negotiate with your lender on your behalf.

- Be persistent: The process of getting a loan modification can be complex and time-consuming, and it may take several attempts before you are successful. It’s important to be persistent and continue to advocate for yourself and your financial needs.

Remember that it’s in the best interest of both you and your lender to find a solution that allows you to keep your home. By working together and exploring all of your options, you may be able to find a solution that helps you get back on track with your mortgage payments.